Thank you for visiting the NEW ZEALAND HP Store

-

Contact Us

CONTACT USCall us

- Sales

- 0800 854 848

- Technical support

- +64 9884 8600

Mon-Fri 9.00am - 6.00pm

(exc. Public Holidays)

Chat with us- Our specialist are here to help

- Live chat

Mon-Fri 9.00am - 6.00pm

(exc. Public Holidays)

Submit feedback We value your opinion! - My Account

Search

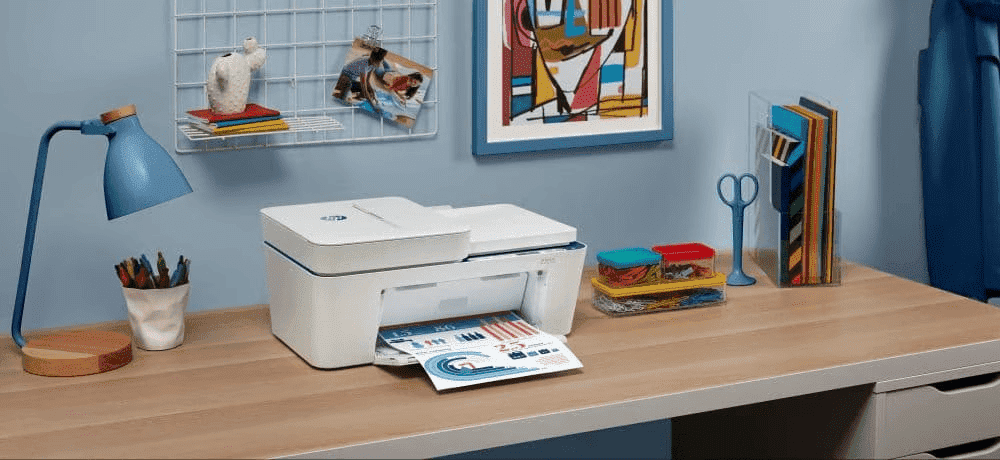

Your Office Printer: Lease or Buy?

Posted:

November 25, 2023

Categories:

Printer

If you are in the market for a new printer, you may be wondering whether you should buy it outright, or if it makes more sense to lease your printer. Before making your decision, there are a number of things to consider.

The computer and printer leasing industry is a $2 billion business, but it has declined over the past few years. Why? Computers and printers are more affordable than ever before, making it easier for businesses to own their equipment with a smaller initial outlay.

However, even with the lower barrier to entry, office printer leasing has considerable perks. In this guide, we’ll compare owning your equipment to leasing it so you can make the right decision for your company. You may be surprised at how each option offers distinct value to a growing business looking to quickly upgrade its office space.

Contents

Buying vs. leasing: what's the difference?

Choosing a printer is a lot like choosing a car. You’ll have two options: lease or purchase.

When purchasing, you pick the printer you want and either pay in full or finance it. The printer immediately becomes your company’s personal property. You may have to deal with taxes, delivery fees, and maybe some installation costs.

Leasing doesn’t require you to have all of the cash up front. Additionally, you may have to sign a monthly service contract that goes beyond just the cost of the printer. Many lease contracts are more “managed service” agreements than simply equipment leases.

Your services package may include regular maintenance, repairs, ink or toner replacement, paper supply, and firmware upgrades. Most leases have a minimum loan term, and there may be a fee for canceling early.

Whether you purchase or lease, you may be able to deal with the manufacturer directly, which grants you access to additional service plans or discounts. Otherwise, it’s common to acquire your printer from a business machine reseller, who may also provide service options for maintenance and repair, even on printers purchased outright.

Buying a printer

Shopping for a printer can be exciting, especially if you’ve been using an outdated model for some time. With so much new tech available, it can be hard to decide among all the options. Color printing, faxing, and inkjet vs. laser are just a few of the details you’ll have to sort out, but whether you put a new printer on your credit card or use a business equipment loan to make the purchase, there are positives and negatives to consider.

ADVANTAGES TO BUYING

What else can you look forward to besides a new printer? Consider these perks.

1. Investment

When you buy a printer, it's yours to keep, and the full value of the equipment is yours. It becomes a business asset and is included in the list of property items as part of your company's total worth. When you lease a device, you never actually own the equipment, so you can't claim its valuation.

2. Tax advantages

Most business purchases can be counted as deductions or expenses, depending on how you file. With the new Section 179 depreciation rules, businesses can deduct the full cost of most printers in the same year they put them into service., This means that you don't have to write off the value of the expense slowly over a schedule but can count the entire purchase price at once. For a business investing in a new fleet of printers, this has significant tax benefits.

3. Flexibility

When you own your own printer, you are free to use it as much as you please. You can make as many copies as you wish and refill the ink or toner as needed. Often, with lease agreements, there are caps on how many pages you can print or copy with the printer.

DISADVANTAGES TO BUYING

Even though printer ownership can offer advantages, purchasing has its downsides.

1. A large initial investment

If you need just one printer to start with, the upfront cost may not be much of a burden. For those who require one or more enterprise-level machines, however, the cost may become significant. If you’re on a tight budget or need to protect cash flow, purchasing can be a burden.

2. Large responsibility

Just like with home or car ownership, if you own your printer outright, you are responsible for the bill if something goes wrong. It’s up to you to pay for repairs in an emergency, or simply lose access to that printer’s functionality. From printer jams to software glitches, you will need to budget for the ongoing time and expense to make sure everything runs smoothly with your new printer.

Leasing a printer

How does the landscape change if you’ve decided to let someone else be the owner? Leases come in several categories, but for this article, we’re referring to capital leases. Capital leases essentially equate to renting, with the ability to buy at the end of the contract. Here is a closer examination of the advantages and disadvantages in this scenario so you can better understand whether leasing makes sense for your business.

ADVANTAGES TO LEASING

What are the benefits of leasing a printer?

1. Freedom from responsibility

When it comes to upkeep, maintenance, and repairs, the manufacturer has service people who are intimately familiar with their product. Most lease companies are not only well-versed in how to fix their own machines, you can usually expect quick service or repair from them that’s also included in your lease pricing. For those with stressed-out IT departments, this is a major perk.

2. Lower initial investment

Even if cash flow is an issue, leasing allows you to get a high-tech printer into your office right away. Enjoy the prints and service plans, but pay each month instead of up front. For those who need a steady, planned budget, this option can help not only ease cash woes, but make accounting easier with a clear monthly cost. Buying one printer may not be a problem for your business, but getting 20 new machines into your office tomorrow may only be possible through a lease agreement.

3. Access to newer tech

When you buy a printer, you’re limited to that machine until you decide to invest again. With some lease contracts, on the other hand, you may have the option to “trade up” when tech changes. Whether this is included in the pricing plan or you pay an upgrade fee to modernize, the cost to upgrade may be significantly lower than a repurchase.

4. Easy disposal

Have you ever tried getting rid of an old printer or copier? With regulations making it difficult to simply dispose of your old devices in a landfill, leasing offers a simplified way to scrap your outdated printer.

DISADVANTAGES TO LEASING

If it sounds like leasing is the answer to all your problems, don’t discount these downsides.

1. Lack of equity

Because you don't purchase the printer, you don't own it. That means it isn't an asset that assigns value to your business. For those who are trying to build equity, the move to leasing may be counterproductive.

2. Possible fewer tax advantages

While you can usually write off the cost of a lease, it may not give you the same returns as an outright purchase. You’ll want to speak with your accountant or tax professional for details but, as a general rule, you can deduct most of the money spent on eligible office equipment and services. If you purchase outright, you’ll take a bigger benefit upfront, unlike leasing, where it’s spread out over time.

3. Usage limitations

With your own property, you can use it as you see fit. Leasing, of course, involves someone else’s gear. You’ll need to abide by their agreement, which may dictate how often you use the printer, the number of pages you print, and who has access to the printer. You may even be required to use their choice of paper or ink.

Which option is best?

There's no quick answer to tell you if leasing or buying is for you. Consider the answers to these questions to help you envision how you'll use a printer in your office and which option will best satisfy your needs:

- How many printers will we need?

- What is our initial budget?

- Are we likely to use it according to lease limitations?

- Do we want to have an asset when we’re done?

- What tax benefits do we need to see?

- Is there a need to upgrade frequently?

Summary

There are many printer purchase and lease programs available for businesses, and some have a hybrid approach, such as payment plans for ownership, business equipment financing, and rental programs with the option to buy out at the end. If you don’t see the exact thing you’re looking for in either a purchase or lease agreement, you can always ask.

You can also reach out to get a customized business analysis of your unique printing needs. HP’s managed print services are just one way to streamline your printing, and our reps are on-hand to help you weigh the cost benefits of each, so you can feel confident in your choice, whatever that may be. Get in touch today to begin your free analysis.

Products purchased through this store are sold and fulfilled by Ingram Micro (NZ) LTD

CONTACT US

Call us

- Sales

- 0800 854 848

- Technical support

- +64 9884 8600

Mon-Fri 9.00am - 6.00pm

(exc. Public Holidays)

Chat with us

- Our specialist are here to help

- Live chat

Mon-Fri 9.00am - 6.00pm

(exc. Public Holidays)

Submit feedback

We value your opinion!